How to Claim VAT Exemption

Selected products on our site are eligible for VAT exemption. For more information on eligibility, please view VAT Exemptions Explained.

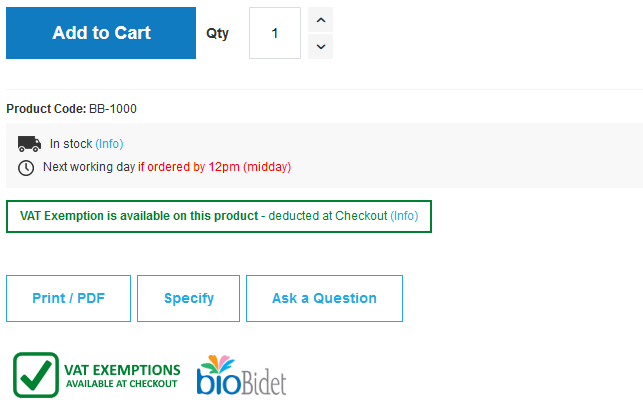

Step 1: How do I know if the product can be ordered without the VAT?

On all our product pages, below the “Availability and lead time” the product's eligibility for 'VAT exemption” status is detailed:

- VAT Exemption is available on this product - deducted at Checkout (Info)

- The green ‘Tick’ icon, will also be displayed with the product Icons

Step 2: Add the product to cart

Select your quantity and press the 'Add to Cart' button...

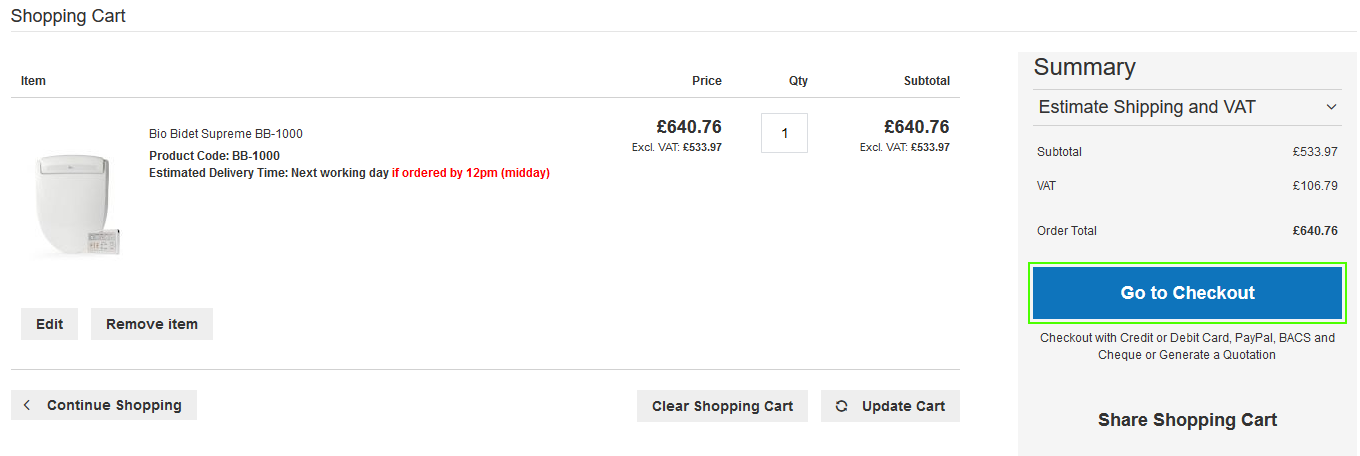

Then you can:

- View and Edit your Cart, where you will see the product displayed with and without VAT...

- Once you have added all the products and quantities you require to your cart, press the 'Go to Checkout ' button...

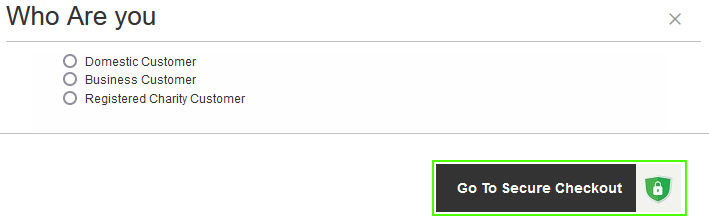

Step 3: Please confirm ‘Who are you’:

To simplify your checkout experience, please select the Customer type making the purchase:

- Domestic Customer

- Business Customer

- Registered Charity Customer

And click ‘Go to Secure Checkout’

Step 4: Checkout and complete payment

You will now be directed to our Secure checkout:

- Enter your delivery address, we use Postcode / Address lookup

- When you select your Payment method you can change the Billing Address if different

- Note: If there is a delivery charge i.e. Pressalit, you will be charged VAT on the shipping

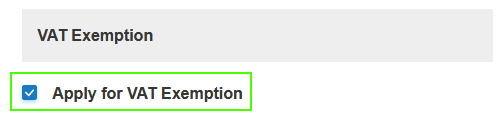

Step 5: Claiming VAT Exemption:

Tick the “Apply for VAT Exemption” box:

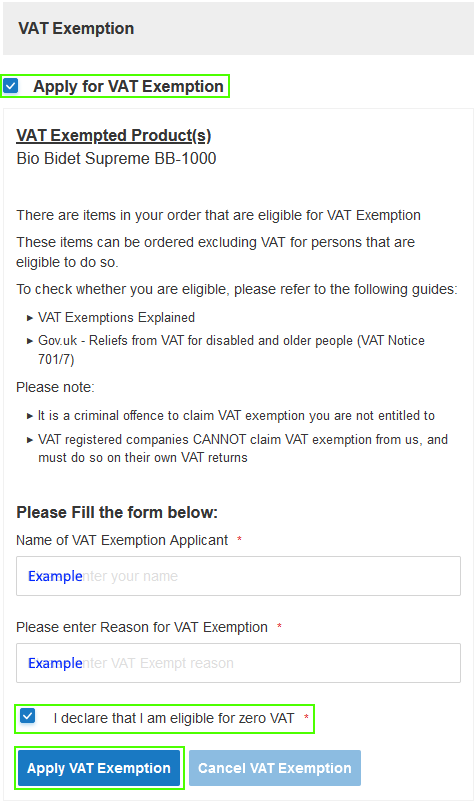

The VAT Exemption box will open and only lists the products in your cart that are eligible for “VAT Exemption”.

Note: ‘Business customers’ if you enter your VAT number in Delivery/Billing information fields. the VAT Exemption box will not show.

Note: “Registered Charity customers” your charity must have Charitable Status to claim.

If you are VAT Registered, it is illegal and you are not permitted to claim VAT Exemption from us, we will provide you with a VAT paid invoice receipt so you can claim back the VAT on your own VAT return.

Follow the instructions, in the VAT Exemption box, the wording is different for each Customer Type and complete the text boxes for:

- Name of VAT Exempt Applicant or Name of Registered Charity

- Reason for VAT Exemption

Then select:

- "I declare that am eligible for zero VAT"

- and "Apply VAT Exemption"

Step 6: Order summary and Buy Now

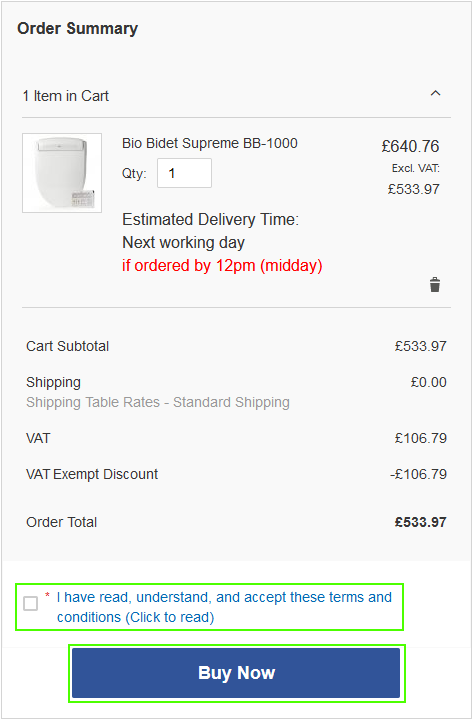

Once you have completed and clicked the "Apply VAT Exemption" button the Order summary will auto-update:

Please take time to review your order and that you have entered your Payment details.

Once you have read and agreed to our Terms and Conditions, please tick the related box before confirming your order via the 'Buy Now' button...

Your order with VAT exemption is now complete.